Managing financial transactions is one of the most important tasks in any ERP system. In Microsoft Dynamics 365 Business Central (BC), this is done through the General Journal. If you are new to Business Central, this guide will walk you through the step by step process of posting journal entries with simple examples.

Table of Contents

What is a General Journal in Business Central?

A General Journal is a worksheet where you can post financial transactions directly to General Ledger (G/L) accounts, customers, vendors, bank accounts, or fixed assets.

It is commonly used for:

- Adjustments (e.g., accruals, provisions)

- Manual entries (e.g., depreciation, corrections)

- Opening balances

- Inter company postings

Step by Step: Posting a General Journal Entry in BC

Following are simple steps to perform Business Central General Journal Posting

1. Navigate to General Journals

In the search bar, type “General Journals” and open the page.

Select the appropriate Journal Batch (e.g., DEFAULT).

2. Fill in Journal Line Details

Each line in the journal represents one side of the entry.

Posting Date: The date of the transaction.

Document No.: Unique number (can be manual or auto-generated).

Account Type: Choose G/L Account, Customer, Vendor, Bank, Fixed Asset, etc.

Account No.: Select the account from the chart of accounts or master data.

Description: Write a short note about the entry (e.g., “Office Rent for August”).

Debit / Credit Amount: Enter the value in debit or credit.

Tip: Business Central automatically checks that the total debits = total credits before posting.

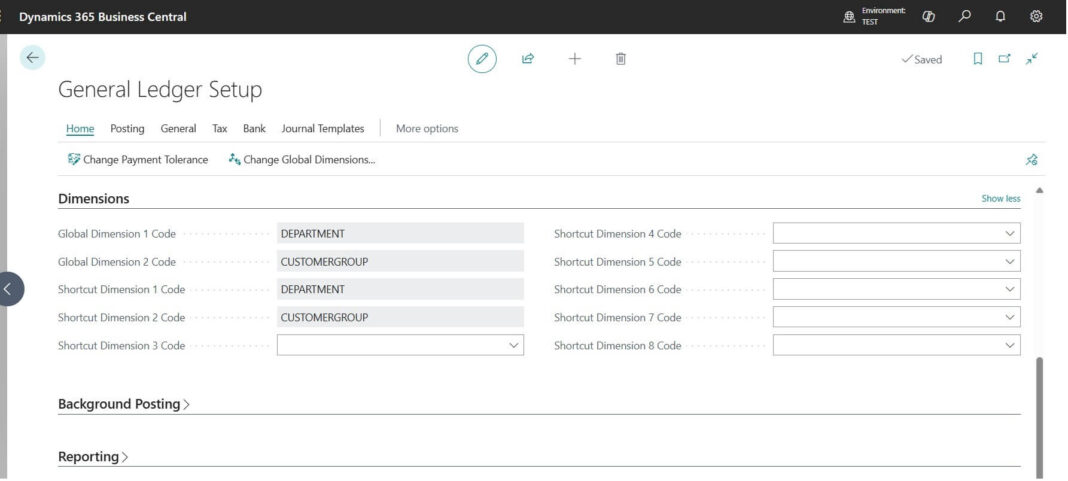

3. Add Dimensions (Optional but Recommended)

Dimensions (like Department, Project, Branch) can be added to classify the transaction.

This helps in reporting later (e.g., Profit and Loss by Department).

4. Preview Posting

Click Preview Posting to see how the entry will affect G/L accounts.

Check for any errors or warnings.

5. Post the Journal

Once reviewed, click Post (or Post and Print if you need a voucher copy).

The transaction is now posted to the General Ledger.

Example: Recording Office Rent Payment in General Journals

For getting easy understanding on the consider following example of Office Rent Payment entry passing in system

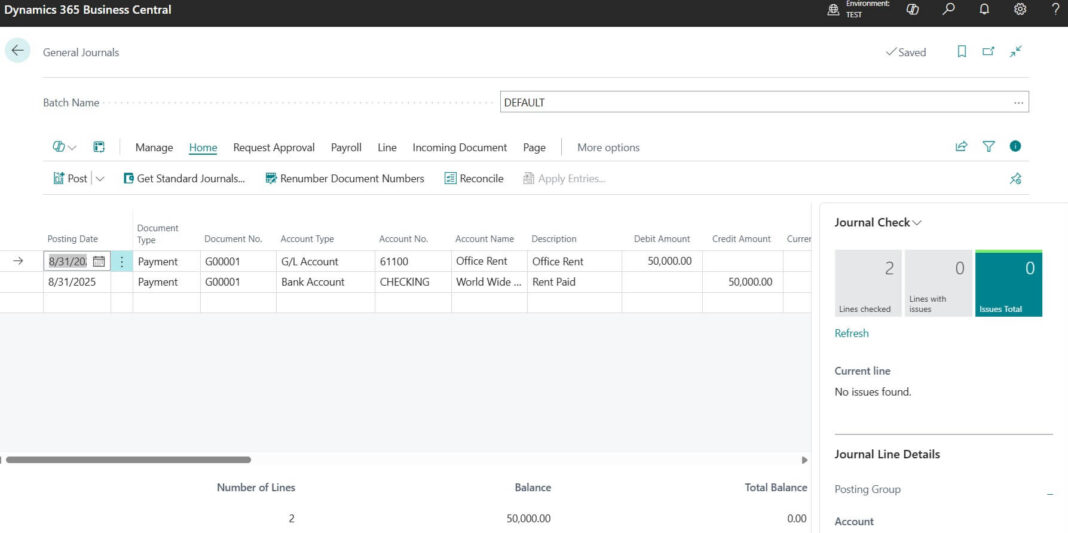

As you can see in this example created the rent payment lines. On right side of the page you may find the Journal Check screen where shows if there any error in the line created on issues Total Column. For Example out of balance Account you have used while creating this GJV etc.

On bottom you may see the “Total Balance” column where it will show the balance per Document No. It should be zero.

Explanation of Sample Entry GJV

On 31st August 2025, the company records a General Journal Voucher (GJV) to capture the office rent payment.

The transaction has two sides:

- The Office Rent Expense account (6110) is debited with ₹50,000.

- This shows that the company has incurred an expense for using office space.

- A debit to an expense account increases the cost in the books.

- The Bank Account (1010) is credited with ₹50,000.

- This reflects that money has gone out of the company’s bank to pay the rent.

- A credit to a bank or cash account reduces the available balance.

The Document Type used here is Payment, because the transaction involves an actual outflow of money to settle an obligation.

So, in Summary:

The company paid ₹50,000 from its bank towards office rent, increasing expenses and reducing the bank balance.

Tip: Common Document Types in GJV (General Journal)

Payment – When money goes out (e.g., rent, supplier payment).

Invoice – For vendor/customer invoice postings.

Credit Memo – For reversal/return of invoices.

Refund – When returning money to a customer.

Best Practices for General Journal Entries

Following are best practices we would suggest for you as per experience regarding Business Central General Journal Posting.

- Always use clear descriptions.

- Apply dimensions for better reporting.

- Use number series for automatic document numbers.

- Avoid making too many manual entries use system features (e.g., recurring journals, payment journals) when possible.

Key Takeaways

Following are the summary of key takeaways from this content

- The General Journal is a flexible tool in Business Central for recording financial transactions.

- Always check debit = credit before posting.

- Use Preview Posting to avoid mistakes.

- Dimensions add powerful reporting capabilities.

Frequently Asked Questions (FAQs)

General Journal is a tool in Business Central that allows you to record financial transactions such as expenses, income, accruals, or adjustments directly into the ledger.

You can access it by searching for “General Journals” in the search bar. From there, select the specific batch where you want to post entries.

Business Central has a Recurring General Journal feature that lets you automatically post repeated entries like rent, salaries, or insurance.

General Journal: Used for all types of financial adjustments, accruals, or corrections.

Cash Receipt / Payment Journal: Specifically designed for customer payments and vendor payments.

Yes. Every journal entry must balance (Debit = Credit). You either enter the balancing account directly or let the system calculate it automatically.

Yes. You can assign Dimensions (like Department, Project, or Region) to each line to improve financial reporting.

Once posted, the entry updates the General Ledger, Vendor, Customer, or Bank accounts (depending on your setup). It becomes a permanent part of your accounting records.

You cannot directly delete a posted entry. Instead, you can use the Correct or Reverse function to fix mistakes in a proper audit-compliant way.

Stay tuned to NavisionPlanet for more simple, step-by-step functional guides on Business Central.