When you start using Business Central, one of the first things you will do is set up your vendors. Vendors are simply the suppliers you buy goods or services from.

If you only create a vendor record without linking it to the right posting groups, your purchase invoices and payments may end up in the wrong accounts. That’s where Vendor Posting Groups and General Business Posting Groups come in.

Let’s go step by step.

Table of Contents

Vendor Creation and Vendor Posting Group Setup Steps in BC

Step 1: Create a Vendor Card

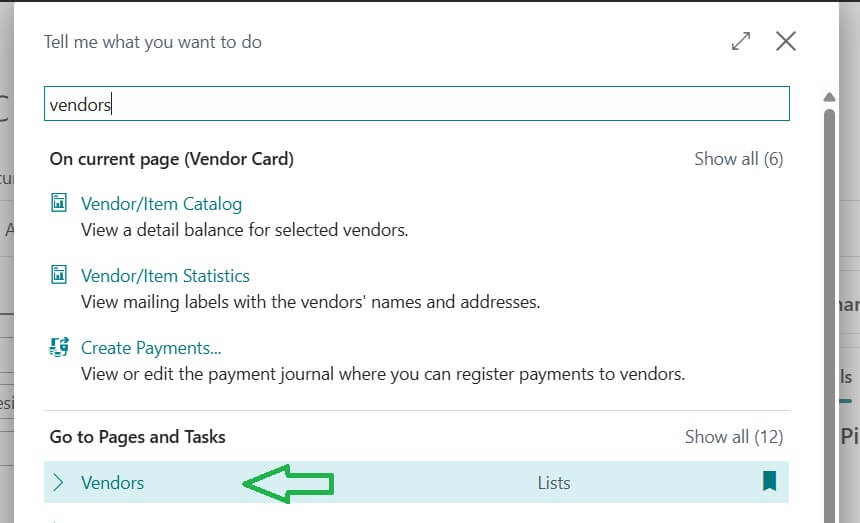

- Go to Vendors in Business Central.

Tip: You may try Business Central Keyboard shortcuts for faster navigation.

- Click New to create a new vendor.

- Enter key details:

- Vendor name and address

- Contact details (phone, email)

- Currency (for example INR, USD, EUR)

- Payment terms (e.g., 30 days)

Think of the Vendor Card as your “digital file” for each supplier. The more information you store here, the easier your day to day transactions will be.

Step 2: Understand Posting Groups

Posting Groups are the bridge between vendors and your accounting system. They make sure every invoice, payment, or credit memo hits the right General Ledger accounts.

There are two you will deal with for vendors:

Vendor Posting Group : tells BC which account to use for vendor balances (Accounts Payable).

Example: Domestic vendors -> 2110 (Domestic Payables)

Foreign vendors -> 2120 (Foreign Payables)

General Business Posting Group : handles tax rules like VAT or GST, based on vendor type or region.

Example: Domestic vendors -> GST setup

Import vendors -> Customs Duty

Vendor Posting Group Setup Fields

Following are the key fields available for Vendor Posting group setup in Dynamics NAV / Business Central.

- Payable Account : Payables due to vendors.

- Service Charge Acc.: Service charges due to vendors.

- Payment Disc. Debit Acc.: Reductions in payment discounts received from vendors.

- Payment Disc. Credit Acc.: Payment discounts received from vendors.

- Payment Tolerance Debit acc.: Purchase tolerance Must use together with Business Posting Group

- Payment Tolerance Credit Acc.: Purchase tolerance Must use together with Business Posting Group

- Debit Curr. Appln. Rndg. Acc.: Specifies the general ledger account to use when you post rounding differences. These differences can occur when you apply entries in different currencies to one another.

- Credit Curr. Appln. Rndg. Acc.: Specifies the general ledger account to use when you post rounding differences. These differences can occur when you apply entries in different currencies to one another.

- Debit Rounding Account: Specifies the general ledger account number to use when you post rounding differences from a remaining amount.

- Invoice Rounding Account: Specifies the general ledger account to use when amounts result from invoice rounding when you post transactions that involve vendors.

Step 3: Assign Posting Groups to the Vendor

On the Vendor Card:

- Pick the correct Vendor Posting Group (DOMESTIC, FOREIGN, etc.).

- Pick the General Business Posting Group for tax handling.

If these aren’t set correctly, your reports and balances will be wrong so double-check before moving on.

To Assign the Vendor Posting Group to Vendor: (Dynamics NAV)

- Open the Vendor Card (FINANCIAL MANAGEMENT –> PAYABLES –> VENDORS)and browse to the vendor on which you want to assign the Vendor Posting Group.

- Click on Invoicing tab.

- Select a Vendor Posting Group.

Step 4: Test It with a Purchase Invoice

- Create a Purchase Invoice for your new vendor.

- Add an item or expense line.

- Post the invoice.

- Check the General Ledger entries to see if everything went to the right accounts.

If the postings look correct, you’re good to go.

Best Practices from Experience

Following are the best practices

- Keep posting group names simple (DOMESTIC, FOREIGN, IMPORT).

- Don’t create hundreds of posting groups group vendors logically.

- Train your accounts team on the difference between Vendor Posting Groups (balances) and General Business Posting Groups (tax).

- Review and update groups regularly, especially when tax rules change

Final Thoughts

Setting up vendors in Business Central is not just about creating a record it is about making sure every transaction flows to the right accounts.

- The Vendor Card stores who you are dealing with.

- The Posting Groups decide where the money goes in your books.

Get this right, and you’ll avoid messy corrections later and make your month-end close a lot smoother.

FAQ

It Is the master record for each supplier. It stores their details (name, address, contacts, currency, payment terms) so you can process purchases and payments.

They tell Business Central which account to use for Accounts Payable balances.

Vendor Posting Group Where vendor balances are posted in the G/L.

General Business Posting Group = Which tax rules (VAT, GST, customs) apply.

No. You group vendors (e.g., Domestic, Foreign, Import) and assign those groups to many vendors.

Invoices will hit the wrong accounts, making reports inaccurate. Always test with a sample invoice after setup.