Table of Contents

How to process various documents after GST ?

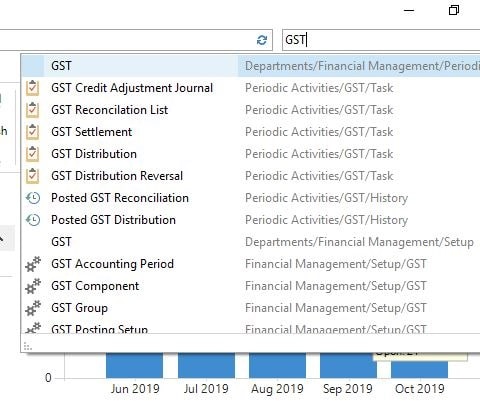

| GST Pages , Reports etc showing when entered ‘GST’ |

- Purchase Order

- Purchase Invoice

- Purchase Credit Memo

- Transfer Documents

- Sub-Contracting Orders

- Sales Orders

- Sales Invoices

- Sales Credit Memo

Purchase Order : GST

|

| GST Impact – Purchase Order Page |

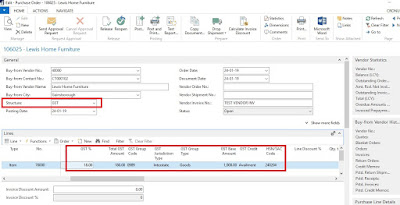

But in practical if we do analysis of this document then, you will see several additional fields added on the Purchase Line, Purchase Statistics Page and Structure with GST selected. These new fields are came from Item Master and Vendor Masters. As I told all earlier Purchase Order having several type of transactions like Registered, Un registered, Composite , Import and Exempted.

All the following fields are automatically coming or calculated during the Calculate Structure (Alt + U + U) available on Purchase Order.

GST % : This field will show the actual GST calculated based upon the setup

Total GST Amount: This will show total GST amount calculated on Line.

GST Group Code: This is place where you can mention type of Goods you are purchasing like Goods, Service etc. You can divide your goods into different naming methodology to accomodate different type of tax structure exist for your goods.

GST Jurisdiction: Will show Interstate or Intrastate based on the Purchase happening

GST Credit: This will show whether the credit available for this purchase or not.

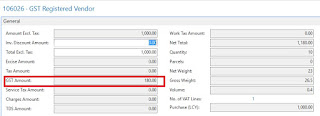

Purchase Order Statics Page Changes Highlighted in following image

|

| GST Impact : Purchase Order Statics Page |

Purchase Order Statics page opening via F7 are shown above where added new field GST Amount. This field will show GST Amount calculated based upon the setups.

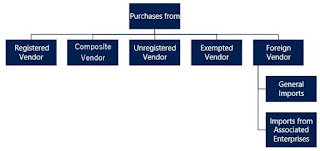

Following purchase scenarios exist on GST.

|

| GST Purchase Scenarios |

- Registered Vendor

- Composite Vendor

- Unregistered Vendor

- Exempted Vendor

- Foreign Vendor

- General Imports

- Imports From Associated Enterprises

Intrastate Registered Vendor Purchase Scenario

For creating the Purchase Order there is no difference but careful thing you have to notice is Microsoft Dynamics NAV – Vendor Card you have to mention following GST setups mandatory

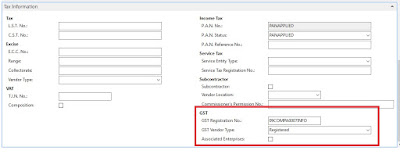

|

| Vendor Setup – GST |

GST Vendor Type: Registered

Also need to verify whether the Vendor having state code same as that of Location Code.

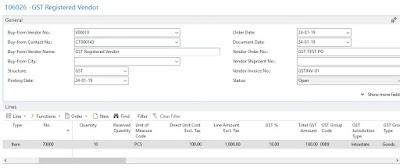

After creating the purchase order will look like following

|

| GST Registered Vendor PO Screen |

You have press “Calculate Structure Values” to reflect the proper tax rate.

Note: Structure value, GST related values like GST % reflecting in the line etc.

|

| Purchase Statistics Page GST |

Purchase Invoice and Purchase Credit Memo you can follow similar process. Always check GST amount before posting.

If are still can’t able to calculate the tax then do comment on this post we will help you.

To be continued… Please visit this page further process changes related to GST.