Bank reconciliation is one of the most important financial tasks for any company. It helps you ensure that the bank balance in your books matches the balance in your actual bank statement. In Microsoft Dynamics 365 Business Central (BC), this process is simple, efficient, and user friendly.

In this blog, we will walk you through the Bank Reconciliation process in Business Central with clear steps and examples.

Imagine this: You open your bank statement and see $1,00,000. But when you check your company books, it shows $98,500. Where did that $1,500 go? Bank fees? Missed entry? A typo?

That’s exactly why Bank Reconciliation is so important it is your way of making sure your books and your bank are on the same page.

And the best part? If you are using Microsoft Dynamics 365 Business Central, the reconciliation process is smooth, smart, and designed to save you time.

Let’s walk through it together.

Table of Contents

What is Bank Reconciliation (in simple words)?

Think of reconciliation like balancing your wallet with your bank passbook.

- Your company records = What you think you spent or earned.

- Bank statement = What the bank says actually happened.

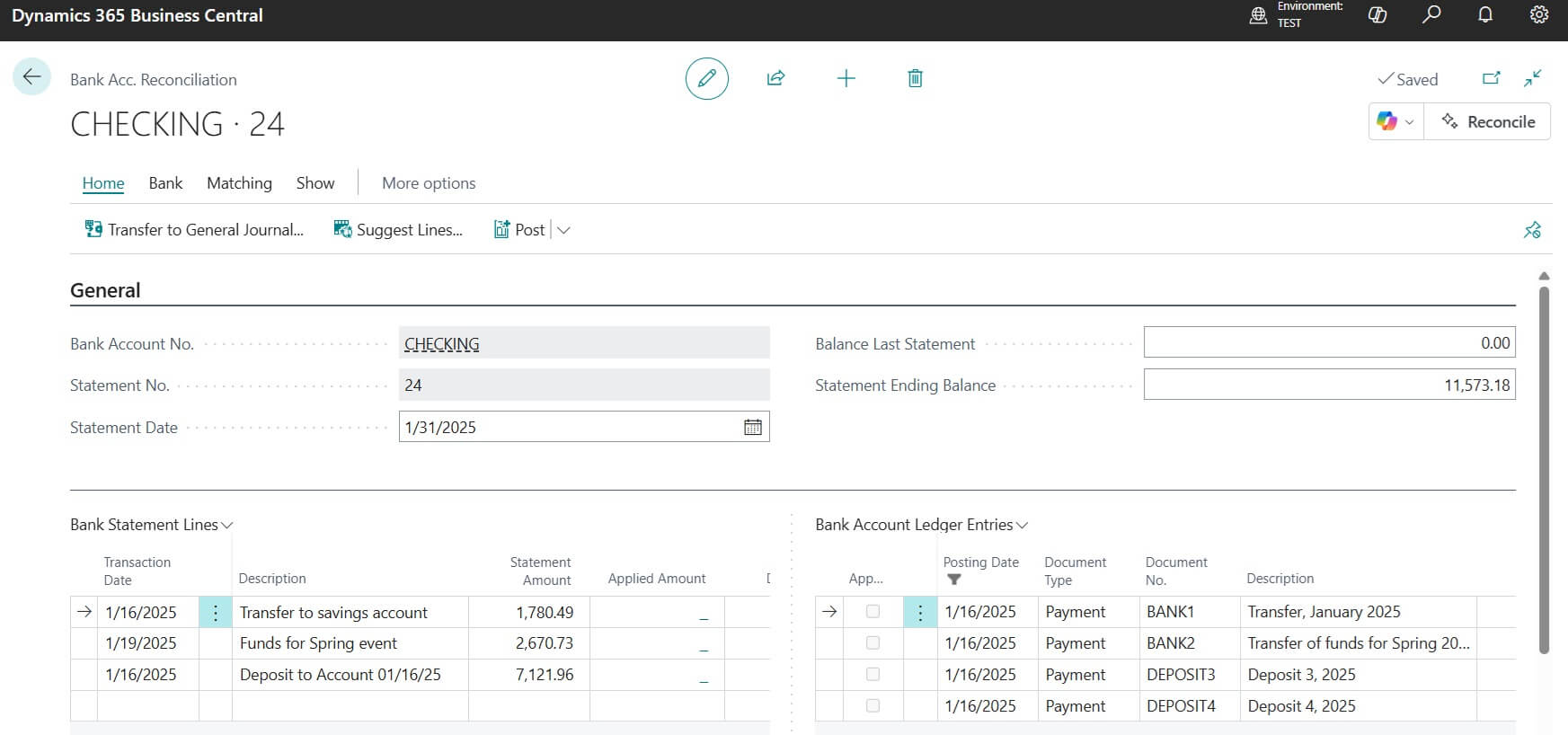

The Bank Acc. Reconciliation Window in Business Central

In Business Central, the reconciliation happens inside the Bank Acc. Reconciliation window.

- The header section is where you enter information such as the bank account and the statement details.

- The lines section is where the actual reconciliation takes place. Here, you match posted transactions from BC with the transactions on the bank statement.

- If there are differences, you can enter or adjust transactions (like bank charges or missing entries).

Once everything agrees, you finish by posting the reconciliation. This ensures that your bank account balance in Business Central matches the real balance reported by the bank.

Step by Step: How to do Bank Account Reconcile in Business Central

- Open the Reconciliation Page

Search for Bank Account Reconciliation in BC. Pick the bank account you want to work on. - Bring in the Bank Statement

If your bank supports it -> Import the statement file.

If not -> Manually enter the transactions. - Match the Transactions

BC will try to auto match entries for you (huge time saver).

If it misses something, you can match manually. - Fix Differences

Found a mismatch? Do not panic.

>Add missing entries like Bank Charges or Interest Income.

>Adjust timing issues (like cheques not yet cleared). - Post and Relax

Once everything agrees, hit Post. Done!

Your books now reflect the exact bank balance.

Latest Business Central versions support Copilot (AI) supported Bank Reconciliation as well

Quick Example

Bank Statement says:

- Opening Balance: ₹50,000

- Deposits: ₹20,000

- Bank Charges: ₹500

- Closing Balance: ₹69,500

In Business Central:

- Deposits match automatically.

- You add ₹500 as Bank Charges.

- Final balance matches ₹69,500 -> Fully reconciled.

Pro Tips to Make Life Easier

- Do it every month (do not wait till year end).

- Use imported bank statements whenever possible—it is faster.

- Double-check unmatched entries before posting.

- Always document adjustments for audits.

Common Mistakes People Make

Following are the common mistakes related to Bank Account Reconcilation

- Ignoring tiny adjustments (₹100 bank fee still matters).

- Reconciling only once a year (big headache later).

- Skipping manual review because “auto-match did it.”

- Forgetting to post after matching.

FAQs : Bank Reconciliation in Business Central

Yes, but you will need to cancel and redo the reconciliation carefully.

No, each bank account needs to be reconciled separately.

You can always enter transactions manually.

Yes, adjustments like bank charges or interest are posted directly to the GL.

Key Takeaway

Bank reconciliation in Business Central does not have to be a boring chore. With the Bank Acc. Reconciliation window, you:

- Match transactions easily

- Spot errors quickly

- Post adjustments instantly

Do it regularly, and you’ll always have peace of mind knowing your books and bank balance are perfectly aligned.

Pro tip: Think of reconciliation like brushing your teeth do it regularly, and you will avoid big problems later.

Stay tuned to NavisionPlanet for more simple, step-by-step functional guides on Business Central.