Closing the fiscal year is one of the most important tasks for accountants and finance teams. In Microsoft Dynamics 365 Business Central, the process is streamlined so you can make sure your books are accurate, compliant, and ready for the new year. Year End Closing in Microsoft Dynamics 365 Business Central explained here in detail.

In this post I will explain:

- What fiscal year closing means

- Steps to close a fiscal year in Business Central

- Best practices and common mistakes to avoid

Table of Contents

What is Fiscal Year Closing?

Fiscal year closing means finalizing all accounts for a financial year. Once closed, the system ensures:

- Income and expense accounts are reset to zero.

- Net profit or loss is transferred to retained earnings.

- Balance sheet accounts carry forward to the next fiscal year.

This process ensures you start fresh with a new year while keeping historical data safe for reporting.

Steps to Close a Fiscal Year in Business Central

How Often?

Once every year. You may need to repeat it if extra entries are added in a year that has already been closed.

Quick Overview

The year-end closing process in Microsoft Dynamics Business Central has three main steps:

- Close the Fiscal Year – mark the year as closed in the Accounting Periods window.

- Create Closing Entries – run the Close Income Statement batch job.

- Post the Entries – finalize the closing entries and update retained earnings.

Note: Closing the year is not mandatory in Business Central, but it is recommended. It ensures that reports like Chart of Accounts and Trial Balance show only open years clearly.

Here is the step by step process to Close a Fiscal Year in Business Central system:

Step 1: Close the Fiscal Year

This step locks all periods in the fiscal year so no one can change them.

Note: You must first create the new fiscal year before closing the old one.

Prerequisites

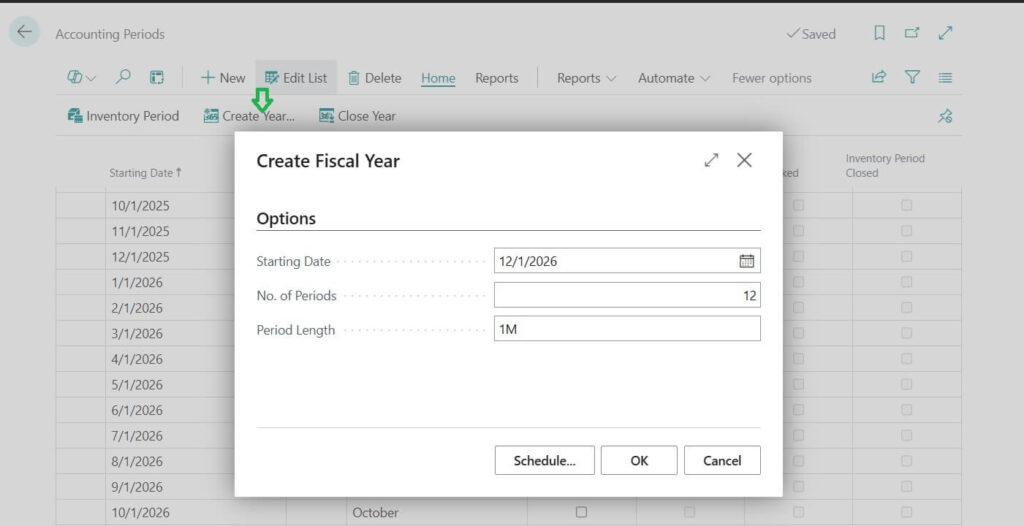

If the current fiscal year not created then create the new fiscal year from Accounting Period (Page) -> Home -> Create Year. Mention the Start Date of required fiscal year, Number of period needs to create its ideally for 12 Months and Period Length=1M. After selecting all required values click on OK to create the fiscal year. Refer following image for reference.

Tip: Following are verification required for transaction level before year closure. >Make sure all General Ledger (G/L) entries, sales, purchase, and inventory postings are completed. >Make sure Transfer Documents posting completed for the closing period. >Reconcile bank accounts and check for pending adjustments.

How to Close a Fiscal Year:

- Go to Departments -> Financial Management -> Periodic Activities -> Fiscal Year -> Accounting Periods on Dynamics NAV or simply search Accounting Periods in Business Central.

- Click Close Year.

- Business Central will suggest the year to close (based on the earliest open year). Confirm by clicking Yes.

To close a non-standard year, tick the New Fiscal Year box in the last period you want to close.

After Closing the Year:

- All periods in that year are marked Closed and Date Locked (cannot be changed).

- Period lengths cannot be edited.

- You can still post entries, but they will be tagged as Prior-Year Entries.

If you add entries later, remember to:

- Run the Close Income Statement batch job again.

- Post the updated entries.

Tip: To stop users from posting in certain periods, set posting dates in General Ledger Setup (Allow Posting From/To).

Step 2: Run the Close Income Statement

This step creates the actual closing journal entries.

How to Run It:

- Go to Departments -> Financial Management -> Periodic Activities -> Fiscal Year -> Close Income Statement on old NAV and for Business Central you may run directly Close Income Statement task

- Fill in the fields:

- Fiscal Year Ending Date – filled automatically with the last day of the year. (In the current example closing 2023. So the date shows 12/31/2023. FYI. this field will populate auto)

Business Central uses a special date format (Cmm/dd/yy). Don’t change it.

- General Journal Template – usually set to GENERAL.

- General Journal Batch – select your batch.

- Document No. – auto-generated from number series (or enter manually).

- Retained Earnings Account – choose your retained earnings account (adjust later if you have multiple).

- Posting Description – defaults to “Close Income Statement”.

- Close By Options:

- Business Unit Code – separate entries per business unit.

- Dimensions – entries per dimension value combination.

- If not used, Business Central makes one entry per account.

- Click OK to run the batch job. Once completed successfully will get following message with confirmation of the required entries are created on Journal details we filled.

Example, current case it will show in “General Journal Template=GENERAL, Gen. Journal Batch=Default” page.

Step 3: Post the Closing Journal

The batch job only prepares the entries; it does not post them automatically.

- Review the journal entries.

- Adjust them if you have multiple retained earnings accounts or dimensions.

- Post the journal to complete the year-end closing.

Reminder: The Close Income Statement job can be run multiple times, but you must post the journal each time. Otherwise, duplicate entries may build up.

Example: If your company made a net profit of $10,000, it will be moved to the Retained Earnings (Equity) account.

Example Scenario

Let us say your fiscal year is January 1, 2023 – December 31, 2023.

- All expense accounts (like Rent, Salaries, Utilities) will reset to 0 on January 1, 2024.

- Net Profit/Loss for the year gets transferred to Retained Earnings.

- Balance Sheet accounts (like Assets, Liabilities, Equity) will continue with their balances.

Best Practices for Fiscal Year Closing

- Create a backup before running the closing process.

- Lock posting dates for the old year to avoid mistakes.

- Run trial balance reports and ensure everything balances.

- Use dimensions for detailed reporting and analysis.

- Inform your team let all users know when posting will shift to the new fiscal year.

Common Mistakes to Avoid

Following are the common mistakes to avoid.

- Forgetting to reconcile bank and subledgers before closing.

- Running “Close Income Statement” multiple times.

- Not reviewing retained earnings setup in G/L accounts.

- Closing before completing audits or adjustments.

FAQs – Fiscal Year Closing in Business Central

No, once a year is closed, it cannot be reopened. However, you can post adjusting entries in the new year with the Posting Date Correction feature.

No. Closing the income statement and fiscal year handles G/L. Subledgers (like vendors/customers) do not need special closing.

The system will still allow postings, but reports may not show correct retained earnings. It is best practice to always close on time.

Yes, you can close older fiscal years if they’re still open, but it is recommended to close each year in sequence.

Yes. Dimensions are preserved for historical entries, and new entries can continue with the same setup.

Key Takeaways

- Fiscal Year Closing in Business Central resets income and expense accounts while carrying forward balance sheet accounts.

- Use Close Income Statement to transfer profit/loss to retained earnings.

- Always reconcile, review, and backup before closing.

- Follow best practices to ensure compliance and clean financial reporting.

Stay tuned to NavisionPlanet for more simple, step-by-step functional guides on Business Central.